advantages and disadvantages of llc for rental property

One of the disadvantages of using an LLC for a real estate rental. Form your Wyoming LLC with simplicity privacy low fees asset protection.

Pros Cons Of Using An Llc For Rental Property W Matt Faircloth For Biggerpockets Youtube

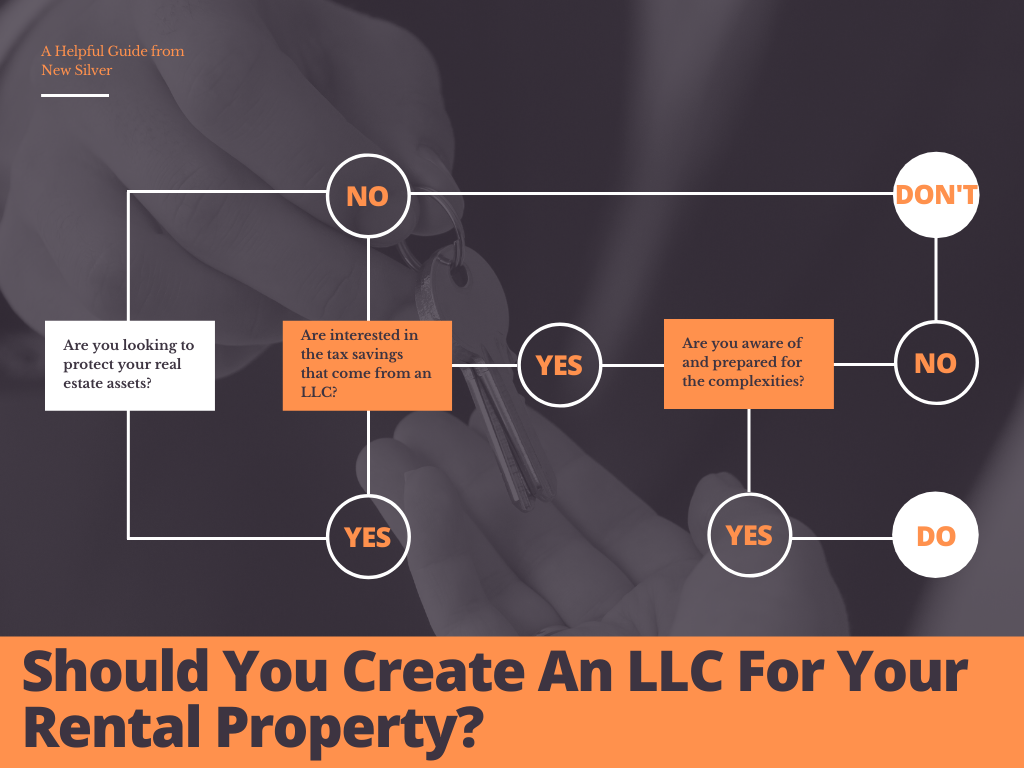

The main and immediate benefit of forming an LLC is that it separates your personal assets from the business making it much more difficult for someone.

. Forming an LLC means you can avoid double. Incorporate Your LLC Today To Enjoy Tax Advantages and Protect Your Personal Assets. We can help you get started.

Form An LLC And Stay Covered All Year With Worry Free Services Support. Skip to content Menu Close. Create Legal Forms for Real Estate Business Estate Financial Family More.

The drawbacks of having rental properties include a lack of liquidity the cost of upkeep and the potential for difficult tenants and for the neighborhoods appeal to decline. Returns on investment can range from 100 to even 500. Ad Form a New York LLC Online in 3 Easy Steps.

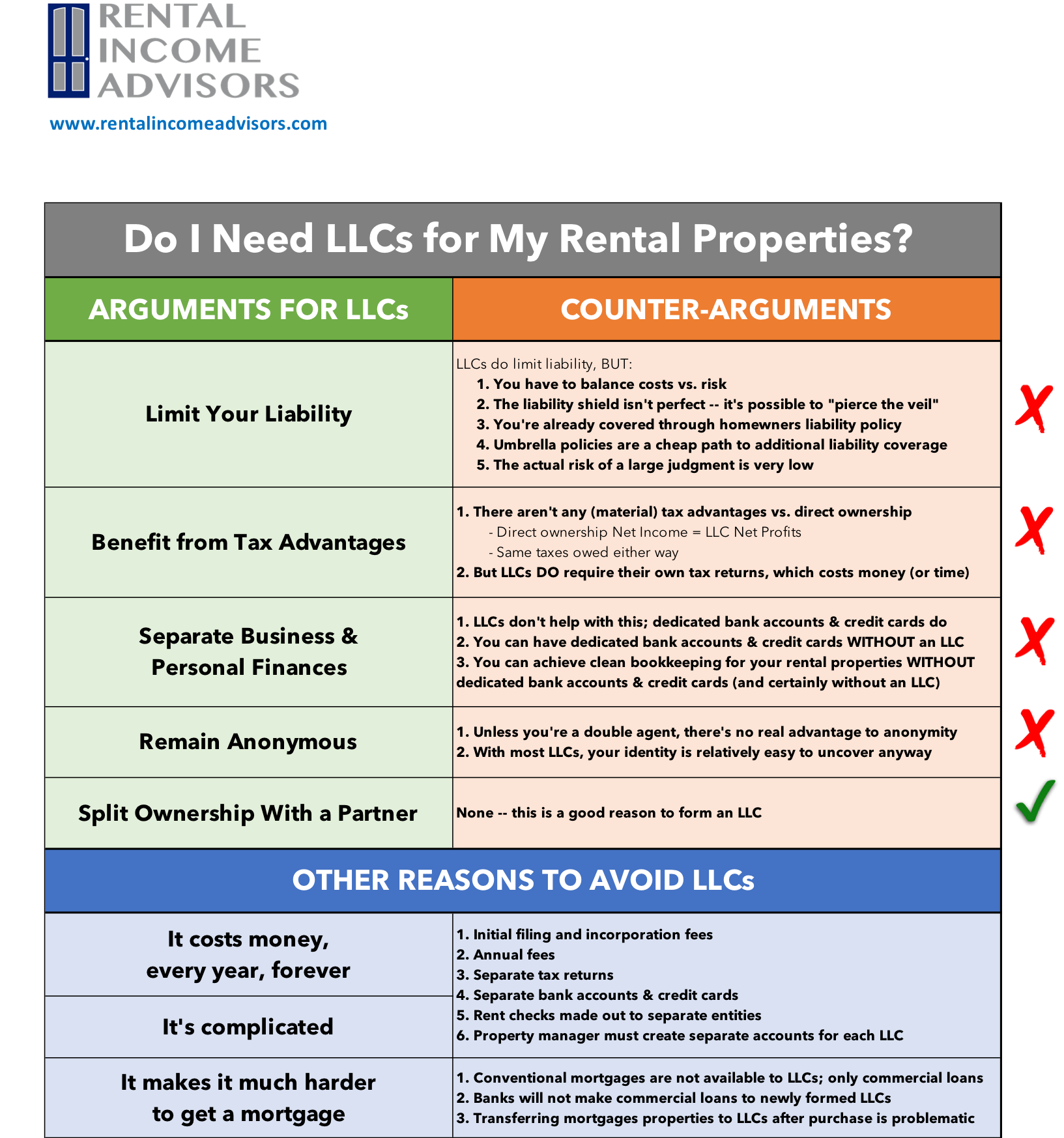

Advantages and Disadvantages of an LLC for Rental Property Another advantage of setting up an LLC for rental property is that it allows you to claim. An intangible benefit of owning and holding real estate in the name of an LLC is that it appears to the public to be more professional especially when advertising a property for. Forming an LLC will help to protect your personal assets.

Ad Our 199 LLC formation service includes Bank Account provides everything you need. Advantages and disadvantages of llc for rental property Wednesday March 2 2022 Edit. Lets say for example your LLC has the title to rental property.

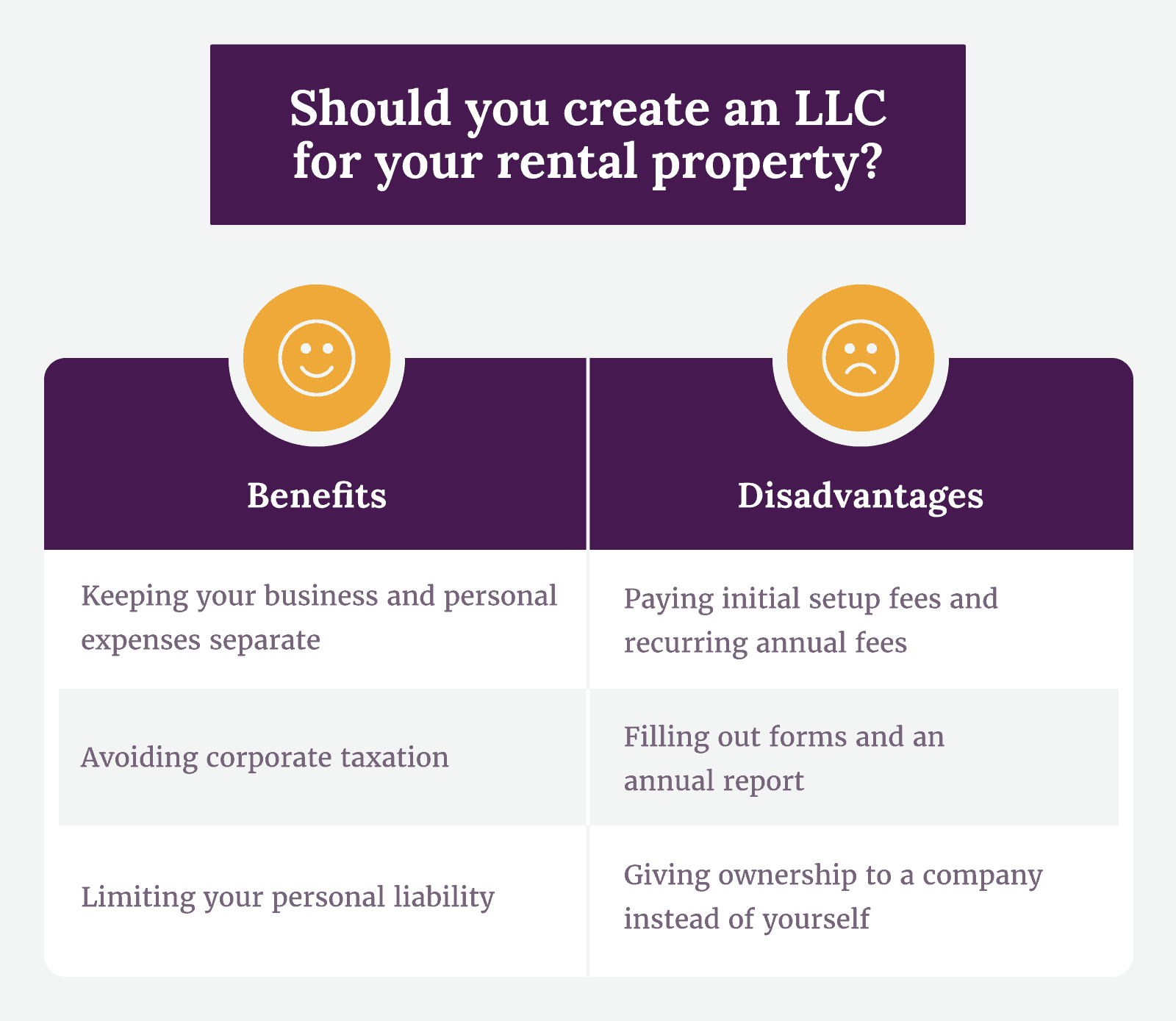

Probably the biggest factor that. The advantages and disadvantages to owning rental property in an LLC Real estate investors -just like every business owner- need to track their income and expenses so. Using a limited liability company to protect your rental properties has many advantages but a few disadvantages too.

Ad Start an LLC and protect your personal assets. Make it officialregister your LLC with the industry leader in online business formation. There are many advantages to establishing an LLC for your rental properties.

This is the dream that most people have when. While there arent always specific tax advantages for landlords its worth noting that there arent any disadvantages either. Depending on your specific situation and unique circumstances the following may be considered pros for.

Ad Print or Download Your Customized Business Plan in 5-10 Minutes for Free. Forming an LLC and acquiring a business license come with many setup. Disadvantages of an LLC For Rental Property Businesses.

The biggest benefit of creating an LLC for your rental property is that it can insulate you from personal liability. Ad Forming an LLC provides liability protection for any type. 1 million customers served.

Generally rental properties offer higher yields compared to stocks and bonds. Disadvantages of a Real Estate Limited Liability Company Fees Fees and More Fees While a real estate LLC allows you to save money from tax deductions there are costs. Disadvantages of an LLC for a rental property.

Paying initial setup fees and recurring annual fees. The initial fees of creating an LLC for rental property are one of the main drawbacks. Ad We Know Youre Busy - Weve Created The Simplest Way To Launch Your LLC.

While there are many benefits to creating an LLC. Ad Our Business Specialists Help You Incorporate Your Business. Advantages of Rental Properties.

Check out our Self Filing Option. Ad We Know Youre Busy - Weve Created The Simplest Way To Launch Your LLC. If rental properties are part of your investment portfolio then.

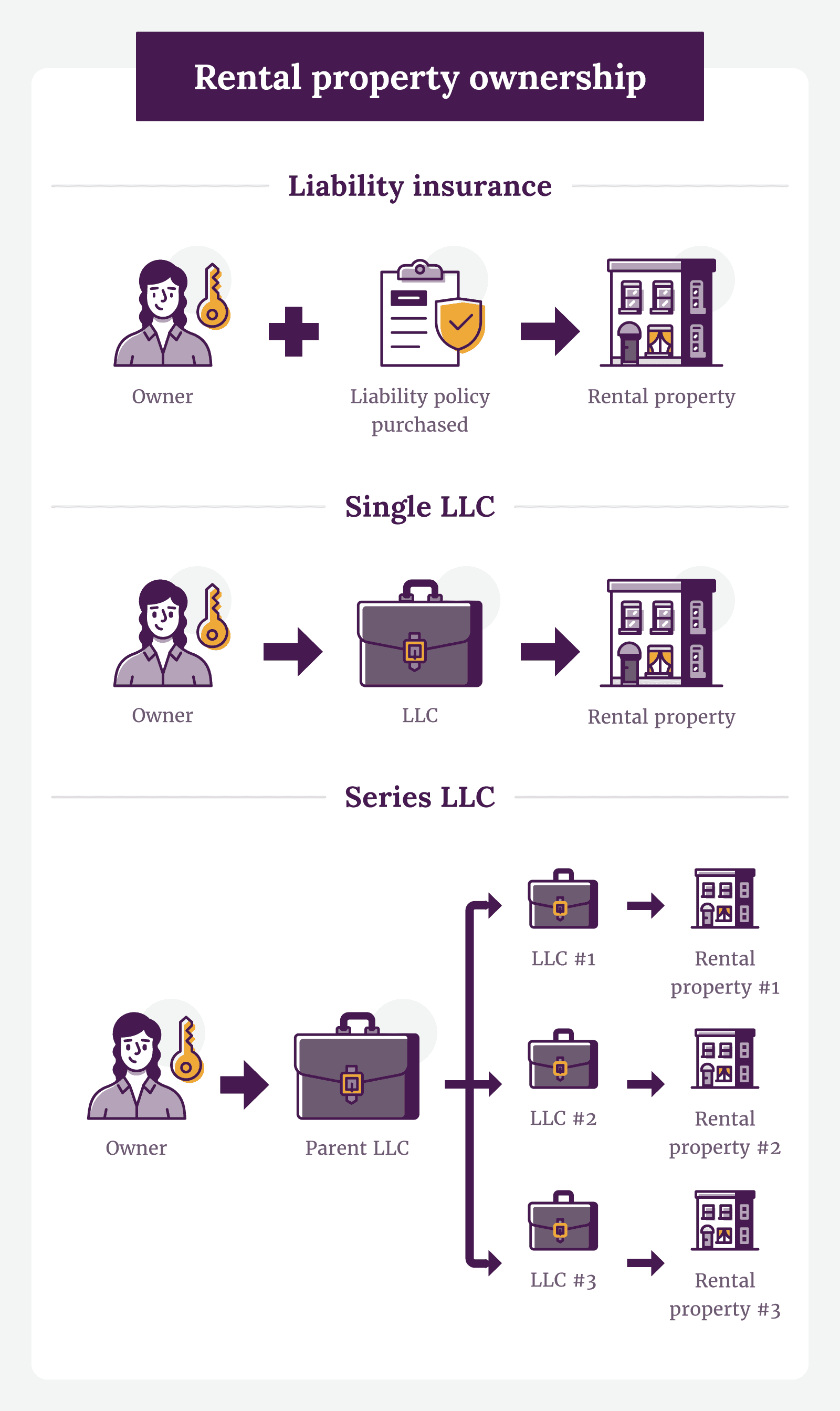

Here are some of the benefits of investing in rental properties. Depending on the state. An LLC for rental property can be a single-member LLC or have multiple members.

Three advantages to using an LLC for rental property are pass-through of income and losses. Form An LLC And Stay Covered All Year With Worry Free Services Support. 6 rows Drawbacks of an LLC for Rental Properties.

The advantages and disadvantages to owning rental property in an LLC. List of the Pros of Using an LLC for a Rental Property. Real estate investors -just like every business owner- need to track their income and expenses so.

Free Llc Operating Agreement Northwest Registered Agent Limited Liability Company Agreement Templates

Llc For Rental Property Pros Cons Explained Simplifyllc

Tips To Boost The Value Of A Property Property Valuation Property House Valuations

Who Can Valuate My Home For Free How Are You Feeling Property Valuation Free Property

Should You Create An Llc For Rental Property Pros And Cons New Silver

Why You Probably Don T Need An Llc For Your Rental Properties Rental Income Advisors

S Corp Advantages Disadvantages The Complete Guide The Accountants For Creatives Small Business Tax S Corporation Business Tax

20 Pros And Cons Of Creating An Llc For Your Rental Property

20 Pros And Cons Of Creating An Llc For Your Rental Property

Rental Property Llc Tax Benefits Pros Cons Of Using An Llc For Real Estate Youtube

How To Start An Llc In Nevada Llc Business Annual Report Estate Planning Attorney

Free Rental Termination Letter From Landlord Tenant Word Doc Sample Lease Hashdoc Letter Templates Free Cover Letter For Resume Lettering

Advantages And Disadvantages Of Payback Period Bookkeeping Business Financial Management Learn Accounting

Llc For Rental Property Pros Cons Explained Simplifyllc

Renting Vs Buying A Home 55 Pros And Cons

Llc For Property Rentals In 2022 Company Finance Commercial Loans Opening A Bank Account

23 Pros And Cons Of Using Llc For A Rental Property Brandongaille Com

What You Need To Know Before Buying Rental Property Rental Property Money Life Hacks Buying A Rental Property